“Why Charleston?”

Charleston, South Carolina remains one of America’s most beloved and admired small cities.

While best known for its historic, seaside location and world-class golf and restaurant scene, Charleston as an industrial market is relatively small. Traditionally, the Charleston industrial market has existed to support the busy Port of Charleston and its thousands of ocean cargo containers that pass through on a weekly basis.

Land prices have remained high along the U.S. east coast and the Charleston industrial market is no exception. This helps explains why Charleston’s 26 million square feet industrial market has clustered around its airport infrastructure and stretches northwest along the I-26 corridor.

HUGE LOGISTICS CENTER TO TAKE SHAPE

Staff reports. The Post & Courier

A rendering shows the Coastal Crossroads speculative industrial warehouse project that will begin construction this week near Summerville. The project will include a 1.1 million-square-foot distribution center — the largest speculative construction yet in the Charleston region.

Construction of the biggest speculative industrial project in the Charleston region kicks off this week with a groundbreaking event for the 1.1 million-square-foot development at Crossroads Logistics Center in Summerville.

The site, near the Jedburg Road exit on Interstate 26, is being built out by a partnership between Citimark Realty and Pure Development. The Indianapolis companies formed Citimark Pure Charleston LLC to buy roughly 131 acres fronting I-26 for $8.75 million last year.

Their first building will eclipse by 10 percent the previous record for a local “spec” project — a 1 million-square-foot structure at the nearby Charleston Trade Center.

A surge of imports coming though the Charleston waterfront is fueling demand for nearby warehouses and distribution centers, namely along Interstate 26 in the Summerville area.

The Crossroads project is scheduled for completion by late 2022. Plans call for three more buildings to rise in two phases totaling an additional 1.53 million square feet at the Berkeley County site.

Wednesday’s groundbreaking will feature speakers from the State Ports Authority, operator of the Port of Charleston, as well as commercial real estate firm CBRE Inc., which is marketing the project.

The term speculative in this instance means that no tenants have been secured at the time construction begins.

While such projects continue to grow in size and scope, they still don’t approach the region’s biggest-single industrial property. That distinction belongs to the cavernous 3 million-square-foot import hub built just up I-26 in Dorchester County for retail giant Walmart.

The Crossroads project is part of a boom in speculative industrial-grade real estate deals in the Charleston area, particularly along the I-26 corridor from North Charleston to Ridgeville. Almost all of it is being driven by the need to store and sort goods that retailers are importing through Charleston.

Mike White, broker in charge of Daniel Island-based Charleston Industrial, said about 5.1 million square feet of “Class A” space is set to open by the end of this year. Most of that space will be snapped up before a certificate of occupancy is issued, he added.

“The conditions of a high demand and low volume of space available will continue,” White said.

The Coastal Crossroads warehouse project near Summerville will include a 1.1 million-square-foot distribution center.

INDUSTRIAL DEVELOPER FINDS BIG OPPORTUNITY IN LOCAL MARKET

By David Wren. The Post & Courier

Adam Seger is an executive with Indianapolis-based Pure Development, which broke ground recently on a 1.1 million-square-foot warehouse near Summerville.

Adam Seger credits a family holiday visit during the COVID-19 lockdown with the idea to build one of the largest speculative warehouse projects in the Charleston region.

“My wife’s mother lives in West Ashley and we were visiting around Christmas in 2020 and my mother-in-law could tell I was bored,” Seger, an executive with Indianapolis-based Pure Development, said during a groundbreaking event April 13 at the construction site off Interstate 26 near Summerville.

“My mother-in-law was like, ‘Get your butt out of the house,’” Seger said. “So, I went out and just got super enthused about everything that’s going on at the port and the harbor deepening — it seemed like a macro wave that it would be smart to get in front of.”

Seger reported his findings back to the home office in the Hoosier State and was told to start making offers on available land. Pure Development ultimately teamed up with Citimark Realty, paying $8.75 million a year ago for the 131-acre site at the Jedburg exit.

The 1.1 million-square-foot Coastal Crossroads project is expected to attract a retail distributor that will move cargo from the Port of Charleston to an inland network of stores.

It’s one of just three speculative deals — meaning no tenants have been secured at the time construction starts — topping the 1 million-square-foot mark in the region. A surge in retail imports and the growing Southeast consumer market means there likely will be more in the near future.

Micah Mallace is senior vice president of marketing and sales for the State Ports Authority.

“The interest of companies wanting to locate in Charleston and South Carolina is only expanding,” said Micah Mallace, senior vice president of marketing and sales for the S.C. State Ports Authority. Mallace said the port operator is fielding inquiries from some of the nation’s largest retailers looking for storage and distribution space.

“The pandemic really solidified the place of the giant retailers — the Walmarts, Targets and Amazons — it’s really accelerated their pace of growth,” he said. “It’s a story of the ‘bigs’ getting bigger.”

And the big retailers need big buildings.

“The market is still vibrant — we’re definitely seeing larger buildings than we’ve ever seen,” said Bob Barrineau, senior vice president with the Charleston office of CBRE, the commercial real estate firm in charge of marketing the Coastal Crossroads property.

Barrineau said he’s seeing a mix of retail and manufacturing customers looking for space in the region, with the Volvo Cars plant in Ridgeville attracting attention from electric-vehicle suppliers like battery manufacturers. And they are wanting space quickly, with lead times of typically months instead of a year or two.

“We’re getting to the point where we can find out just how vibrant our market is with the big-box buildings,” Barrineau said, adding he expects a 1.5 million-square-foot warehouse eventually will test the local market’s strength.

A report by Daniel Island-based Charleston Industrial shows that 5.1 million square feet of speculative warehouse construction is in the pipeline for 2022, and 85 percent of that space is expected to find a tenant before work wraps up.

The report predates the start of construction of Coastal Crossroads and the announcement by Dallas-based Dalfen Industrial of a 1.3 million-square-foot warehouse — the area’s biggest to date — planned for Palmetto Commerce Park in North Charleston.

Interest in the Dalfen project “has been a lot more than we were hoping for and expecting, which is great,” said Kevin Caille, the Texas developer’s Southeast market manager. A single e-commerce retailer is expected to fill that space, he said.

All of that new construction is in addition to 1.9 million square feet of space that was leased during the first quarter of this year.

“Shockingly, there is no existing ‘Class A’ space over 40,000 square feet available to be leased and occupied today anywhere in Charleston,” said Mike White, broker in charge for Charleston Industrial. “Warehouse users will have to commit now but wait until (at least) the third quarter of 2022 to occupy their new warehouse space.”

Imported consumer goods continue to break records at the port, which moved 263,344 20-foot-long containers through its terminals in March — the most in a single month and topping the previous high hit in November. Mallace, the maritime agency’s marketing chief, said the flood of imports means more warehouse space is needed.

“We have to be able to continue to develop more,” he said. “If we don’t want to run out of toilet paper and we want to continue buying gym equipment for the home — which we’ve learned we’re not going to use — we have to have available buildings to do so.”

RECORD-BREAKING CHARLESTON INDUSTRIAL MARKET

It’s hard to imagine that it's been exactly two years since the COVID-19 pandemic stopped the world in its tracks. Despite this disruption, we are witnessing a record-breaking expansion of the Charleston Industrial Market! Thirty years from now, economists will look back at this time in history and make comparisons of the COVID economic slowdown to the disruptive impacts of The Great Recession of 2008. While the pandemic has doubtlessly affected our daily lives, it has also accelerated the Charleston Industrial real estate market in profound ways.

Charleston County’s Palmetto Commerce Park

As global travel ground to a halt in March of 2020, the fate of our local economy was uncertain. In the months that followed, we experienced mask mandates and guidelines on how business could be conducted. Business leaders did not comprehend how to plan for the severity and impact of this new disease. The quick, logical decision was to reduce contact between each other by “remote working”. As many Americans were forced to work from home, their buying habits shifted quickly to adapt to these new conditions created by lockdowns.

During the decade leading up to the COVID-19 pandemic, advancements in logistical technologies gave way to the “delivery tomorrow” supply chain model, thereby giving newly homebound consumers the ability to order all manner of staples and distractions needed for daily life. Amazon and other major retailers are often credited with creating an entirely new level of expectation for receiving goods at home, disrupting the traditional rhythm of order and delivery. Clearly, a new consumer demand standard has spread across every aspect of American life.

Supply Chains Move from West Coast to East Coast

Fueled by a surge in demand for consumer goods, retailers have had to adapt their warehouse footprint and logistical supply chain to stay competitive and relevant. Companies have increased their domestic inventories to meet consumer demands for faster deliveries, resulting in unprecedented growth in the Charleston Industrial real estate market. Corporations now recognize the demand for more warehouses closer to the homes of these consumers. In the parlance of the logistics industry, the “last mile” became the focus of suppliers large and small.

A number of factors have led to the unprecedented bottlenecks at America’s seaports. Asian production centers curtailed production due to Covid shutdowns. U.S. truckers faced new regulations limiting work hours and highly unpopular vaccine mandates imposed by the new Biden administration. At the macro level, millions of Americans simply left the workforce altogether, choosing government benefits and off-the-books sources of income. It has become obvious that west coast ports do not have the infrastructure or manpower to handle the demand surge in cargo containers that our recovering economy has created.

Ocean freight carriers have found that rerouting their ships through the Panama Canal and offloading at the east coast ports can reduce shipping times. This shift to the east has favorably positioned the Charleston Industrial market for the present-day rapid expansion we are witnessing.

South Carolina Planned Well….and Executed!

Several years ago, the executives at the South Carolina Ports Authority recognized that our available warehouse inventory was falling behind that of our principal competitor, Port of Savannah, in consumer goods and retail-related distribution centers. SCSPA turned its focus toward increasing the volume of ocean cargo containers unloaded at port terminals across Charleston. This advance in container count was driven by attracting more shipping lines running ever larger post-Panamax ships. The State of South Carolina, led by the SCSPA, strategically prepared for this increase in twenty-foot equivalent unit (TEU) totals by deepening our harbor channel and constructing the new Hugh Letterman Terminal. SCSPA developed and expanded two highly successful inland ports that energize their Upstate economic activity. In a dramatic move forward, the SCSPA convinced Walmart to build a three million square feet distribution center in nearby Ridgeville, supported by direct rail connection to the terminal, signaling to the entire logistics industry that South Carolina is committed to accommodating the delivery and distribution of household and consumer goods. This pre-pandemic decision was prescient, as the consumer retail footprint of regional distribution centers has more than doubled over the past two years.

The State of South Carolina has made tremendous strides forward in economic expansion, through securing global manufacturers such as The Boeing Company, BMW, Mercedes-Benz Vans, Michelin, and most recently Volvo Cars. As these major employers continue to expand, they attract more suppliers and inventories to conduct additional business in our region. If the local economy continues along this path of growth, more corporate leaders will choose Charleston as a location to expand their businesses.

The Record-Setting 2022 – Year of the Warehouse

Moving into a post-pandemic period, we've seen demand for warehouse space that continues to outpace new construction. Charleston is completing a record-setting First Quarter in 2022 with net absorption totaling over 1.9 million SF leased. There is an additional 5.1 million SF of new Class A space to be delivered by the end of 2022. We predict that 85% of that space will be preleased, meaning a new tenant arriving today is committing to space prior to completion of construction. Shockingly, there is no existing “Class A” space over 40,000 SF available to be leased and occupied today anywhere in Charleston. Warehouse users will have to commit now, but wait until the Third Quarter of 2022, to occupy their new warehouse space.

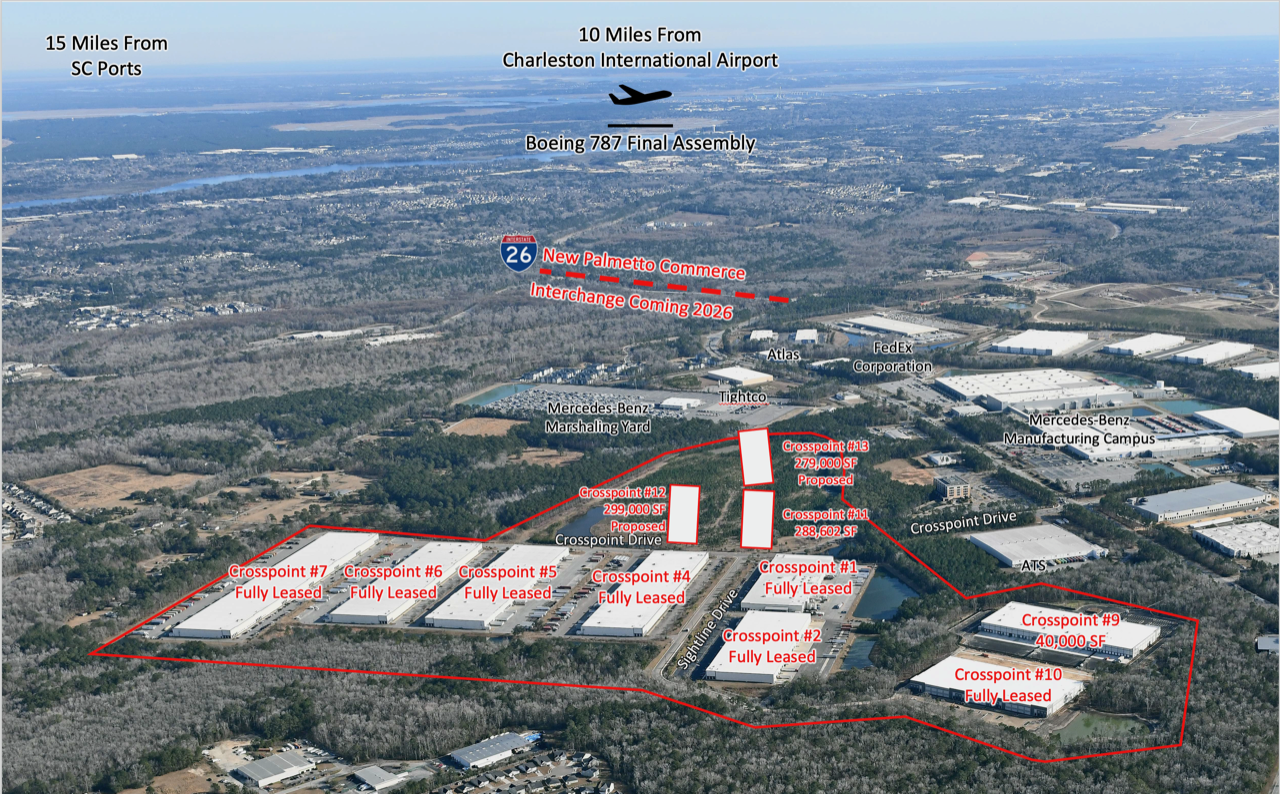

2022 is setting up to be another record-breaking year for the development of distribution centers in the Charleston Industrial market. The conditions of a high demand and low volume of space available will continue. Traditionally popular sites like Crosspoint, located within Charleston County’s Palmetto Commerce Park, will remain fully leased throughout 2022. Crosspoint Building #9 will be delivered near the end of 2022. New park developments such as Trade Park East in Ladson, Ladson Industrial Park, and Omni Industrial Park in Jedburg will be delivering over 2.0 Million SF by the end of 2022. The lease-up results of this new record will set the bar on how developers will approach 2023. If the current economic factors continue to track in this direction, the Charleston Industrial market holds great opportunity ahead. We at Charleston Industrial will continue to be leading experts on industrial market leasing, lending our expertise to those unfamiliar with our dramatic local market history.

Palmetto Commerce Park

Charleston County

CHARLESTON INDUSTRIAL BOOM AHEAD: 2020-2030

Charleston, South Carolina has been blessed with five primary drivers that are contributing to its current boom in industrial investment and development.

• Boeing’s 787 Dreamliner production and supplier base.

• Defense Contractors and U.S. Navy Weapons Research.

• Mercedes-Benz Vans and Volvo Supply Chains.

• Port of Charleston and the widening of the Panama Canal.

• Charleston’s Quality of Life and U.S. Demographics.

1. Boeing’s 787 Dreamliner production and supplier base.

It has been ten years since the Boeing Corporation had selected North Charleston as its second site for the manufacture of the new 787 Dreamliner. Boeing’s announcement was the culmination of over ten years of hard work and multiple accomplishments by many in South Carolina. Most notably, our Economic Development leaders, Public and Private sectors all pulled together to create the conditions needed for Boeing’s senior management to select Charleston. Now the hard work begins, as we must expand our local supply base so that Boeing’s grand investment will indeed be successful. Boeing suppliers and related companies planning to do business with Boeing will find our website to be especially helpful. Boeing’s 787 manufacturing campus has expanded dramatically over the past decade. The addition of manufacturing space, an airplane painting facility capable of adhering livery on two 787s simultaneously and the acquisition of several hundred addition acres, all point to an inevitable expansion for Boeing’s next generation aircraft, possibly called the Boeing 797?

2. Defense Contractors and Navy Research

While our ships and submarines left years ago, the Charleston industrial market continues to support Defense Contractors conducting valuable research to the U.S. Navy’s Future Weapons programs, known collectively as NAVWAR, formerly SPAWAR. The Navy’s nuclear training center still operates along the banks of the Cooper River. NAVWAR provides the military with future combat weapons testing, analysis and modeling. The Charleston industrial market also houses SAIC, Force Protection, Inc. and other combat vehicle service producers.

3. Mercedes-Benz Vans & Volvo Supply Chain

Charleston County is unique among all American counties as the only one that can boast Original Equipment Manufacturer (OEM) and final assembly of both automotive vehicles (Mercedes-Benz Sprinter Vans) and wide-body commercial aircraft (Boeing 787 Dreamliner). Charleston county is also a key location for the Volvo manufacturing supply chain, given the proximity to the Port of Charleston and large labor base supporting multiple industrial buildings. As the coming decade unfolds we expect both MBV and Volvo to diversify their vehicle offerings and consolidate their supplier base to enhance and support Just-In-Sequence (JIS) manufacturing processes.

4. Port of Charleston & the Panama Canal

The SC State Port Authority (SCSPA) was proud to announce 2019 was their best ever record year for container traffic, both import and export. With the opening of the new Leatherman Terminal in 2022, the SCSPA is expected to double its capacity and welcome larger container vessels with greater delivery volumes. The Global Supply Chain continues to shift from the west coast to the east coast. This increased volume will undoubtedly bring larger industrial projects and distribution centers for consumer goods.

5. Quality of Life & Demographics

Quality of Life drives talent, more skills bring more investment. The current estimate among economic developers is that Charleston, SC attracts 35 new persons relocated here every day. Many come with skills and aspirations of finding high-waged employment among an exceptional Quality of Life. In-bound migration of educated and skilled workers will aid in the attraction of more technological and higher value industrial developments.

DEFENSE IN CHARLESTON

Surely, when someone says “Charleston, South Carolina”, the words “home to some of the nation’s leading defense manufacturers, innovators and engineers” are not what comes to mind. That is, however, just what Charleston, South Carolina is, a home of some of the nation’s top leading manufacturers of defense utilities for the United States Military and Armed Forces. With cutting-edge companies such as Force Protection, Inc. and SAIC and top military grade security software companies such as SPAWAR, it’s hard not to think of Charleston as such.

Force Protection, Inc. based in Ladson, South Carolina and established in 1997 is the nation’s leading developer, designer and manufacturer of survivability solutions, including blast and ballistic wheeled vehicles. Force Protection hosts it’s own ballistics testing area in Edgefield, South Carolina for the development of cutting-edge IED and mine-resistant ambush-protected (MRAP) light tactical vehicles. Many of the MRAP vehicles, the creation of Force Protection, Inc. engineers and scientists, are currently deployed and in use by the U.S. Military.

As recent as May of 2010, Force Protection, Inc. received two similar awards one for $64.2 million for 60 of their Buffalo model tactical vehicles and another for $24 million for 30 Cougar model tactical vehicles. Force Protection, Inc. is also pioneering the way for new solutions to guard U.S. soldiers from the threat of TBI (Traumatic Brain Injury), the most common injury sustained by U.S. Military soldiers. A testament to Force Protection’s superior quality a recent news story broke about one of Force Protection’s own MRAP vehicles being struck by an IED (Improvised Explosive Device). The soldier’s claimed that the only thing on the vehicle that they were unable to fix was the air-conditioning.

SAIC, a Fortune 500 scientific, engineering and technology applications company, founded in 1969 with headquarters in McLean, VA, also has a firm foothold in South Carolina with two different branches in Charleston. SAIC is the leading provider of engineering and technical support for operational test and evaluation of Air Force and other systems. SAIC is also the principal defense contractor for Joint Intelligence Operations Capability-Iraq (JIOC-I). SAIC has also developed the ICIS or Integrated Container Inspection System to examine U.S. cargo without impeding the flow of containers from coast to coast.

Another giant in the realm of defense and naval warfare in Charleston, South Carolina is of course SPAWAR. SPAWAR is a member of the Naval Acquisition Enterprise (NAE) with 7,500 government and 4,000 supporting defense contractors worldwide. SPAWAR is also the Chief engineer, architect and technical assessor of FORCEnet technology for naval warfare systems. SPAWAR provides superior quality to naval cyber systems including both defensive security features and advanced attack techniques into adversarial systems. SPAWAR is the leading provider of integrated solutions for decision superiority and decision-making systems. SPAWAR holds a naval warfare facility in Charleston, South Carolina now known as the SPAWAR Systems Center, Charleston. With these giants of defense and warfare surrounding the Charleston area, the opportunities for industrial expansion cannot help but to grow in number.

WIND TURBINE INSTITUTE AND ENERGY IN CHARLESTON

Charleston is rapidly becoming involved in America’s push for clean and renewable energy and has also become a well-known leader for new technology and innovation. A slew of recent happenings have propelled Charleston and better yet all of South Carolina to the forefront of next generation renewable and clean, wind generated energy.

First, Clemson University received a large $45 million DOE grant for a large scale wind turbine testing facility that is now known as the Clemson University Restoration Institute. This Restoration Institute established in 2004 is devoted to developing environmentally sustainable energies in South Carolina. This grant is the biggest single grant that Clemson University has ever received. This event triggered the mass awareness of South Carolina as the primary wind and renewable energy provider.

This coupled with Charleston’s emerging industrial market pulled in industrial manufacturers from as far away as Germany. The IMO Group, a German based company announced in March of 2010 that they plan to move a division called the IMO USA Corporation, to Charleston, South Carolina. The IMO USA Corp. leased a 40,000 SF facility for the manufacture and production of wind turbine parts, the companies’ trademark. IMO Group is consistently one of Bavaria’s Top 50 companies and is known as the worlds leading manufacturer of slewing rings and blade bearings for wind turbines. The IMO Group stated in their announcement to move to Charleston, South Carolina that in their search for a new home they were interested in only those locations within three hours of a major seaport, and access to a major airport. Also, combined with these advantages, IMO Group has stated that they are delighted about Charleston’s technically trained and academically prepared workforce and is excited about the move. “South Carolina is well known throughout Germany as a good place to do business. Charleston’s strong port coupled with its strengthening profile in alternative energy gave us complete confidence in our decision to come here.”

THE PORT OF CHARLESTON AND THE PANAMA CANAL

The Western Coast of the United States has always been known for its historically bustling ports and empire of cargo ships and manufacturing industry. However, in 2014 many are predicting a major shift from the West Coast ports to East Coast ports. The shipping industry has recently made a move towards bigger ships. These mega container ships are called “post-panamax” ships because of their larger size. This large size also prevents these ships from safely navigating the Panama Canal forcing shipping and unloading to occur mostly on the Western ports of the United States.

Due to an Oct. 22, 2006 referendum, Panamanians approved the Panama Canal Expansion Project which will add a third set of locks allowing the Panama Canal to handle the so called “post-panamax” ships safely and other ships that are more than twice as large as today’s ships easily. This widening of the Panama Canal will promote many shipping companies to make a move from the overcrowded Western ports to the now easily accessible and more efficient ports of the East Coast.

The South Carolina Port Authority is currently preparing for this invasion of giant cargo ships. Already, there are plans in the works to expand the port of Charleston. Also the South Carolina Port Authority has stated that the Charleston port is already “big-ship ready” with a harbor capable of handling up to 47 feet of draft. In fact the Charleston port has already handled one of the world’s biggest ships, the MSC Rita. The MSC Rita steamed into port in February of 2010 with a nearly 48-foot draft and is capable of carrying about 8,100 20-foot-long shipping containers.

The South Carolina Port Authority has also stated that the expansion will not just be a simple add-on to the port but the expansion will be with long-term goals for the future of the Charleston port in mind. The South Carolina Port Authority has already received federal funding in order to do more reconnaissance and study to further deepen the port even more for future heavy cargo ships to easily pass through the port. The Charleston port is gearing up for a surge of incoming ships in 2014 due to the widening of the Panama Canal but the Port Authority is on top of everything, assuring industrial leaders that Charleston will be ready.

CHARLESTON’S QUALITY OF LIFE AND DEMOGRAPHICS

The city has been voted as the most well-mannered and polite city for 11 years running. The icon of Charleston, the Arthur Ravenel, Jr Bridge, constructed in 2005, is the longest cable-stayed bridge in the Western hemisphere and can be seen from almost anywhere in the city. Probably best known for it’s historic downtown area, with grand buildings and church steeples dotting the skyline, some over two hundred years old, Charleston is also a city of new-age and modern appeal.

Charleston’s rich history spans over three centuries and is the historic destination of South Carolina. With Charleston’s legendary Market Street, which houses the Charleston Market, many Mom-and-Pop diners and restaurants, old fashioned candy shops and clothing stores and of course the King Street district which houses some of the finest clothing stores in the Southeast, the city allows for some great, quality shopping. Charleston’s unique culture is a blend of Southern American, English, French and West African elements that serve to create an atmosphere of welcome to newcomers of the Charleston shores.

Many luxury hotels and get-away vacation homes are a part of Charleston’s grand appeal. Yet the tourism in Charleston is nothing but flattering to the peoples who live in the city. There is always something to do in Charleston, whether it’s to visit one of the many museums or art galleries or attend one of the world-class symphonies that call Charleston home. But Charleston has always been famous in the arts: the first theater on American soil was built in 1736 in Charleston county. In fact AmericanStyle magazine has listed Charleston as one of the Top 10 art destinations of the United States. Charleston also annually hosts the Spoleto U.S.A. Festival, which is a 17-day art festival that includes jazz and blues music, ballet and modern dance, theatre and other fantastic performances.

Charleston is also home to one of the most beautiful beaches on the Eastern coast and with Marion Square Park in the center of the city and the possibility for a horse-drawn carriage ride through the historic city available, activities for those who like to be in the open air are never in short supply. The future of Charleston is bright with the airport only a short 15 minute drive, many industrial leaders are now looking to Charleston, not only because of its potential for industrial growth, but because of its wonderful quality of life.

OTHER EVENTS AND VENUES IN CHARLESTON:

LEGAL INFORMATION FOR SOUTH CAROLINA

Below please find a broad overview listing key South Carolina real estate matters that may differ from other states’ real estate procedures.

1) Attorney-Closing State. A licensed South Carolina lawyer must conduct closings in South Carolina that involve real estate. Therefore, in South Carolina, title companies do not close real estate transactions, whether it be a conveyance, financing secured by a mortgage, or a modification thereof. Most real estate attorneys are agents for one or more title companies, and therefore provide title insurance in their capacity as an agent, and conduct the closing in their capacity as buyer’s counsel.

2) Transfer fees. South Carolina law requires a “recording fee” of $3.70 per $1,000 of consideration. This fee is customarily paid by the seller. There are certain exemptions from the “recording fee,” such as the case where the value of the property is less than $100. No recording fees” are paid with respect to recording leases, mortgages or other debt instruments. The “recording fee” does not include the nominal per-page fee that the local Register of Deeds Office or Register of Mesne Conveyances Office charges to file a given document in its records.

3) Withholding Requirements. In the case of the sale of property, South Carolina law requires that, if the seller is not a resident of South Carolina, a portion of the proceeds otherwise payable to the seller must be withheld at closing. This is similar to the federal Foreign Investment in Real Property Tax Act, which requires withholding where the seller is not a US citizen. In South Carolina, the seller is required to sign an affidavit stating whether the withholding requirement applies or whether the seller can claim an exemption from withholding.

4)Transfer of Business Assets/ Tax Lien. South Carolina law provides that where the majority of the assets of a business are sold, any tax that the business generated and was due on or before the transfer date constitutes a lien against the assets “in the hands of the purchaser.” Closing attorneys often handle this issue by obtaining a Certificate of Tax Compliance from the South Carolina Department of Revenue. This should be requested by seller at least 10 business days prior to closing and is only effective for 30 days from issuance.

5) Recordable Form of Documents. To be “recordable” in South Carolina, each party’s signature in a document (e.g., mortgage, deed, easement, etc.) must be witnessed by two people and must be notarized by a Notary Public.

6) Tax Incentives. There are a number of tax incentives that may be available from the State and local governments for projects of certain sizes and job growth. We would be happy to discuss these incentives with you.

7) Real Estate Taxes. In South Carolina, taxes for real property are paid in arrears. Tax bills are generally mailed in October and payment is due by January 15th. Property taxes are calculated, in part, using an assessment ratio determined by the applicable use of the property. For example, an assessment ratio of 4% is applied to residential, owner- occupied real estate, while a 6% assessment ratio is applied to commercial and residential non-owner-occupied real estate and the manufacturing assessment ratio is 10%. The fair market value of real property is subject to reassessment every five years due to periodic countywide reassessments. Any increase in the fair market value of real property resulting from this periodic reassessment is limited to 15%; however, this limit does not apply to the fair market value of additions or improvements to real property in the first year those improvements are subject to property taxes. Additionally, since 2007, the fair market value of real property is reassessed whenever an “assessable transfer of interest” occurs. Such a transfer includes many different kinds of conveyances and transfers of interest, including traditional conveyances by deed.

The above information is intended to serve as a broad overview for educational purposes only and is not intended as legal advice.

For further information, please contact:

M. Jeffrey Vinzani

Graybill, Lansche & Vinzani, LLC

(843) 628-7732

jvinzani@glvlawfirm.com